cryptocurrency tax calculator india

Enter the price for which you. Any form of exchange including that of a cryptocurrency can be broken down to two perspectives- consumption and payment.

Crypto Shiksha In 2022 New Crypto Coins Bitcoin Price Crypto Coin

Cryptocurrency is an exciting and cutting-edge asset class.

. It is added to your taxable salary and you are taxed as. 3 Cointelli Cointelli is the next-generation cloud-based crypto tax preparation software developed by Mark Kang the CEOco-founder and a CPA. Cryptocurrency Price Today.

There are cloud-hosting tools specifically designed for crypto miners. India Business News. The rules on applying a tax on cryptocurrency in India in the Finance Bill 2022 are as follows.

If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in India. No according to the Finance Minister only the individual who receives cryptocurrency would be taxed. How To Use The India Cryptocurrency Tax Calculator.

Cryptocurrency Income Tax Calculation. Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant. 10 to 37 in 2022 depending on your federal.

Recipients of a crypto gift will be taxed as if their gift was a form of income. The holding period is less than 36 months. BearTax - Calculate Crypto Taxes in India.

You simply import all your transaction history and export your report. For higher and additional rate taxpayers tax is charged at 20. What Is A Bitcoin Tax Calculator.

Crypto Tax Calculation Formula in India. ITR that stands for Income Tax Return is a form that an assessee is supposed to submit to the Income Tax Department of India. 30100 CryptoCurrency Sale Price CryptoCurrency Buy Price The Union Budget 2022-23.

Rules for Tax on Cryptocurrency in India. 1 lakh profit of Ethereum minus 50k loss of Bitcoin equals to. Heres how to calculate tax if investing in cryptocurrencies and NFTs in India.

The proposed 30 income tax is applicable from 1 April 2022 and the TDS of 1 is applicable from. It appeals to our sense of cultural evolution our infatuation with new tech and our. 30 tax on cryptocurrency in.

The bitcoin tax calculator shows the income tax liability arising on the transfer of bitcoins based on the provisions of the Income Tax Act. Of India has introduced a scheme for taxation of virtual digital assets including bitcoins cryptocurrency. It was a sea of deep red for the crypto tokens on Monday as the major cryptocurrencies were trading with big cuts spooked by rising inflation.

Cryptocurrency Tax Calculation 2022. Tax2win has done in-depth research on. Blox supports the majority of the crypto coins and guides you through your taxation process.

The gains are short-term capital gains of Rs 120000 Rs 80000 Rs 40000. Any income from the transfer of any virtual digital asset. Crytpo Tax 30 of Crypto Profit.

This article will cover tax aspects from the viewpoint of Indian laws on income generated through crypto-assets. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. UK If you are a basic rate taxpayer you will have to pay 10 tax on cryptocurrency transactions. Section 194S of the Income Tax Act was added to bring such.

You must enter the purchase price and the sale price. Enter your total buying price of all the cryptocurrencies. The crypto tax in India is complicated.

It has been implemented. Tailored as per the Indian tax laws the algorithm. To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value.

This means you can get your books. The nature of exchange and the parties to the. The Centre for Cellular and Molecular Platforms C-CAMP Bengaluru on Monday said it has signed an MoU with TiE India Angels TIA a net.

Following are the steps to use the above Cryptocurrency tax calculator for India.

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Taxation Of Cryptocurrency Or Vda In India Budget Proposal 2022 Quick Review By Ca Umesh Sharma In 2022 Budgeting Cryptocurrency Proposal

China Seeks A Role Global Crypto Framework In 2021 Global Role Framework

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Income Tax Calculator How Cryptocurrency Investors Will Be Taxed From April 1 Mint

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Bitcoin Tax Calculator Calculate Your Tax On Bitcoin

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

New Era Of Bitcoin In Network Marketing Business Network Marketing Business Network Marketing Network Marketing Website

Income Tax Paying Taxes The Outsiders Income Tax

Pin On Robotina Ico Ama Live Event

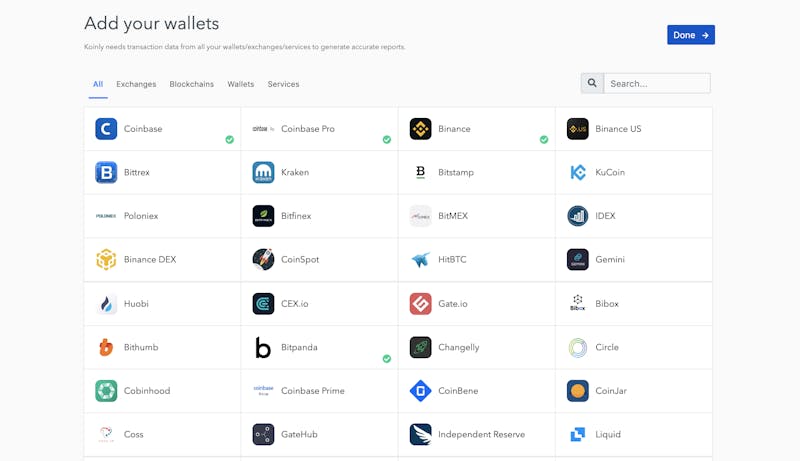

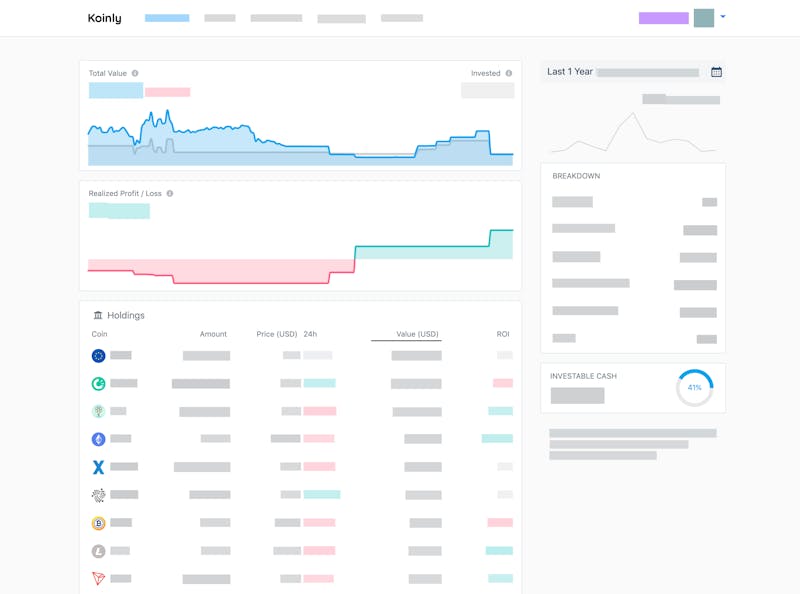

Calculate Your Crypto Taxes With Ease Koinly

How To Calculate Crypto Taxes Koinly

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Mutual Funds Cleartax Investment Platform Provides The Complete Guide To Mutual Funds Types Of Mutual Funds Mutuals Funds Mutual Funds Investing Investing

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company